Feeling a need to track your expenses and savings more closely? My free weekly budget tracker printable and editable Google sheets will make your life much easier!

I talk a lot here on my site about “frugal living” and sticking to your budget. I’ve shared ways to save money on groceries, on clothing, by buying used, and lots more.

Throughout all of those posts there is one thing that I always come back to: “sticking to your budget.” However, what if you don’t actually have a budget? Or what if you technically do but reality never actually seems to line it up with it? (Trust me, I’m familiar with this scenario!)

I’m convinced that what we all need as a first step before we make an actual budget is a good system in place to track our spending (and our earnings!) After all, if you don’t actually know your spending habits and keep track of your weekly expenses, monthly expenses and monthly income, how in the world will you be able to put together a realistic budget?

My husband Pablo and I have run into this problem many times ourselves as we’ve put together very optimistic budgets and then felt discouraged quickly when our actual expenses were different than anticipated. Sometimes a big discrepancy between your “actual vs. budget” means that you simply need to exercise some self control and stop spending, but sometimes it just means that your budget really wasn’t realistic in the first place.

So just to reiterate, if we want to reach our financial goals and get ourselves to a place of financial freedom, the most important thing is that we first have to know what’s going out – every week, every two weeks, or every month, depending on how you prefer to track it.

Printable Weekly Budget Tracker Worksheet

Here’s the great news – which you already know if you read the title of this post: I have a FREE weekly spending tracker printable for you to help you as work to keep track of your money. (Plus, an awesome editable Google sheets doc that will also help, but we’ll get to that in a minute!)

What is a printable budget sheet template?

Take a moment to Google “weekly budget template printable” or “spending / savings tracker printable template” or a combination of the two and you’ll find all sorts of options available out there. In fact there are so many options out there for free printable budget worksheets that it can almost be a bit overwhelming! From weekly to bi-weekly to monthly budget planners, to special budget templates for bullet journals, you can find find free printables in different colors, different styles, and with different categories depending on your needs. But basically, despite all the different kinds, they’re all for the same purpose – tracking your spending.

So, you might ask, if there are already so many other printables out there, why share one here on the website and what’s it for? I’m sharing mine because I’m all about simple templates and my budget template is definitely a simple one. It doesn’t include a bunch of categories or anything – it’s just a simple tool to record every expense in the course of one week.

Why use a printable budget planner template instead of a Google sheet or Excel?

I’m glad you asked! For me, the reason to use a printable and actually physically write out your expenses is because, in a weird way, it makes them seem more real. It’s not just a theoretical thing – you actually spent that money and now you’re taking the time to write it down. This may seem like an extra step to some people and may not be necessary for everyone, but I believe that it’s a helpful practice at least in the beginning when you’re trying to get a better grip on your spending habits.

How do you use a free budget worksheet / printable expense tracker?

To use the weekly budget tracker, simply print it out and stick it on your fridge or somewhere obvious so that you won’t forget to use it.

Then every time you spend money on something just fill in the date, details, and amount. I think you’ll find that just the physical act of writing down each transaction will give you a much better awareness of what’s happening with your finances. This is especially important if your budget is pretty tight and you have to keep a close eye on your account.

Of course, you could go straight to Google sheets each time you have an expense and forgo using a physical printable, but like I said I do think that there’s value at least in the beginning in actually writing down each expense.

Editable Google Sheets Budget Tracker

Once you’ve recorded a week of expenses on your free budget template printable, you’ll can go into Google sheets and enter all of those expenses into an easy Google sheets doc that will help you categorize each expense and get a better visual on your total expenses and savings.

You should also enter your income here, whether your earnings are weekly, bi-weekly, or monthly.

Why use Google sheets instead of another budgeting tool?

There are some great online tools and apps out there to help you track expenses. Every Dollar, YNAB, and others are all great income trackers and can greatly help with budget planning. (Mint was another good one that is now defunct.)

So why use Google sheets instead of another budgeting tool? Well, for one thing it’s free! But also, I think that sometimes the more simple something is the more likely it is that you’ll actually use it, and that’s what I like about Google sheets.

I also like that you have to manually enter your expenses instead of just linking your bank account – because once again, when you actually have to record the transaction yourself it helps you realize what you actually spent.

How do you use a Google Sheets doc to keep track of your expenses?

Let’s walk through my Google sheets budget tracker (made by my husband Pablo – he tracks all our expenses) and I’ll show you step-by-step how easy it is to use!

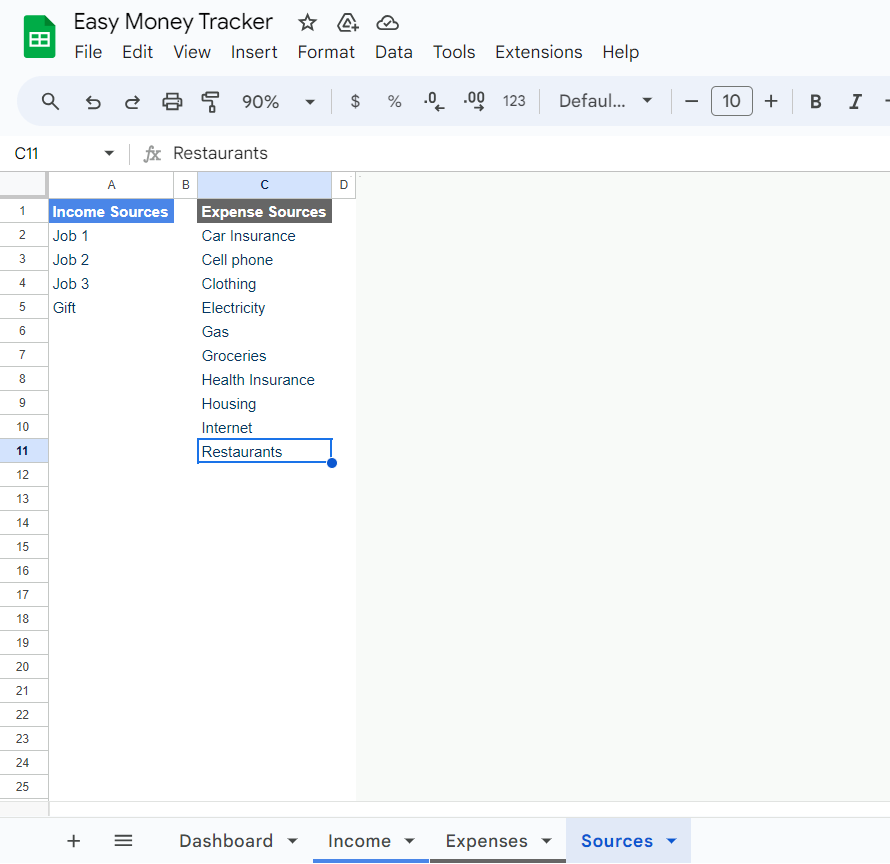

You’ll notice that there are four tabs down at the bottom. The first time you use the Google sheets tracker you’ll want to start by going to the “Sources” tab. Under this tab you can create as many Income and Expense sources as you wish. You’ll notice some sample sources provided for you but you can change those or add to them however you would like. If you think of other expense categories later you can add them anytime so don’t stress out about it.

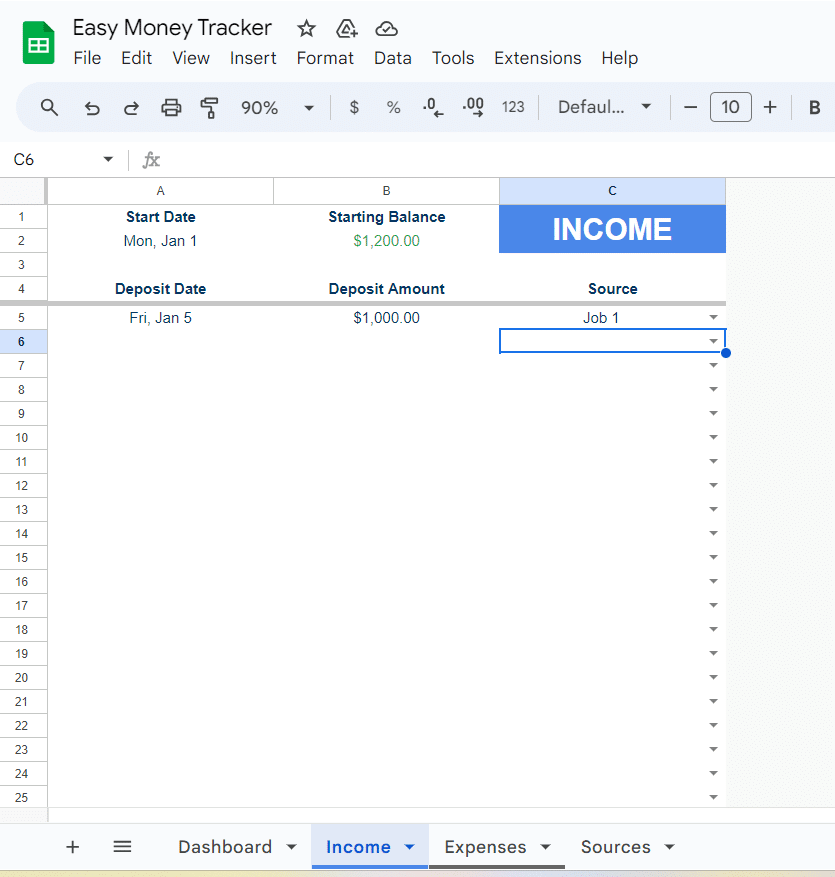

Once you’ve done this, go to the “Income” tab. Enter today’s date and your starting balance—your bank may refer to this as your “available balance.”

Then when you are ready, start entering your earnings (in the “Income” tab) and your expenses (in the “Expenses” tab.) To do this simply:

- Add the date when your earnings or expense transaction occurred.

- Enter the amount that you earned or spent.

- Select the source of your earnings and expenses (you can always go back to the source tab to add additional sources as you think of them.)

Remember, your expenses should already be written on your weekly budget printable, so you’re just copying everything over and then categorizing each of those expenses into their appropriate categories.

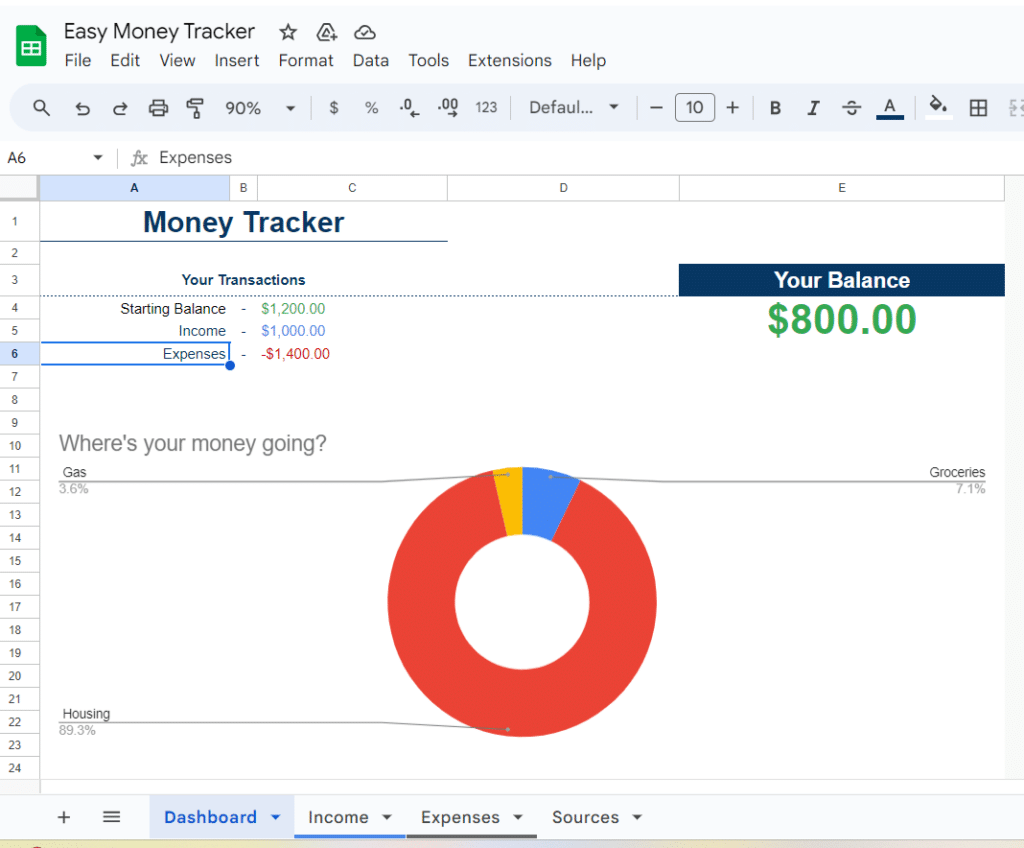

Once you’ve added your expenses and earnings you’ll be able to click on the main “dashboard” tab and see at a glance a nice budget overview of where your money is going. Isn’t that easy?

Then at the end of the month you can look back and see your spending and savings trends and get a better idea of how much money you’re working with and what your personal budget should look like moving forward.

Enter your email below and I’ll send you both my printable weekly budget tracker PDF as well as a link for the Google spreadsheet.

Final Thoughts

Maybe you’ve tried using a budget in the past and it’s been a bust, or you’ve tried to go all Dave Ramsey and burnt out quickly. I’m here to say that first of all I get it, and second, I’ve slowly learned (and am still learning) that it doesn’t have to be all or nothing.

I’m the type that would be excited about the challenge of sticking religiously to a specific budget (in the words of Marie Kondo, that would “spark joy” for me haha.) I can confidently say though that it does not “spark joy” for Pablo and that’s okay because he is not me.

I’ve shared more about differing budget philosophies in marriage and how I’ve lightened up a bit over time in this post. Ultimately, it’s important to remember that there’s not one right way. Dave Ramsey or whatever other financial gurus are not God. You can live wisely and frugally without a specific written budget (and even with a credit card – gasp!) just as you can way over spend when you do have a budget.

The important thing is knowing where your money is going (no burying your head in the sand!) and taking control of your finances instead of letting them control you. That is the purpose of these free budgeting templates, both the physical printable and the Google sheets document and I think you’ll find them to be a great way to accomplish that goal.

Leave a Reply